We Are the Premier EB-5 Hotel Financier and Developer

California Real Estate Regional Center (“CaRE”) is the premier EB-5 hotel financier and developer.

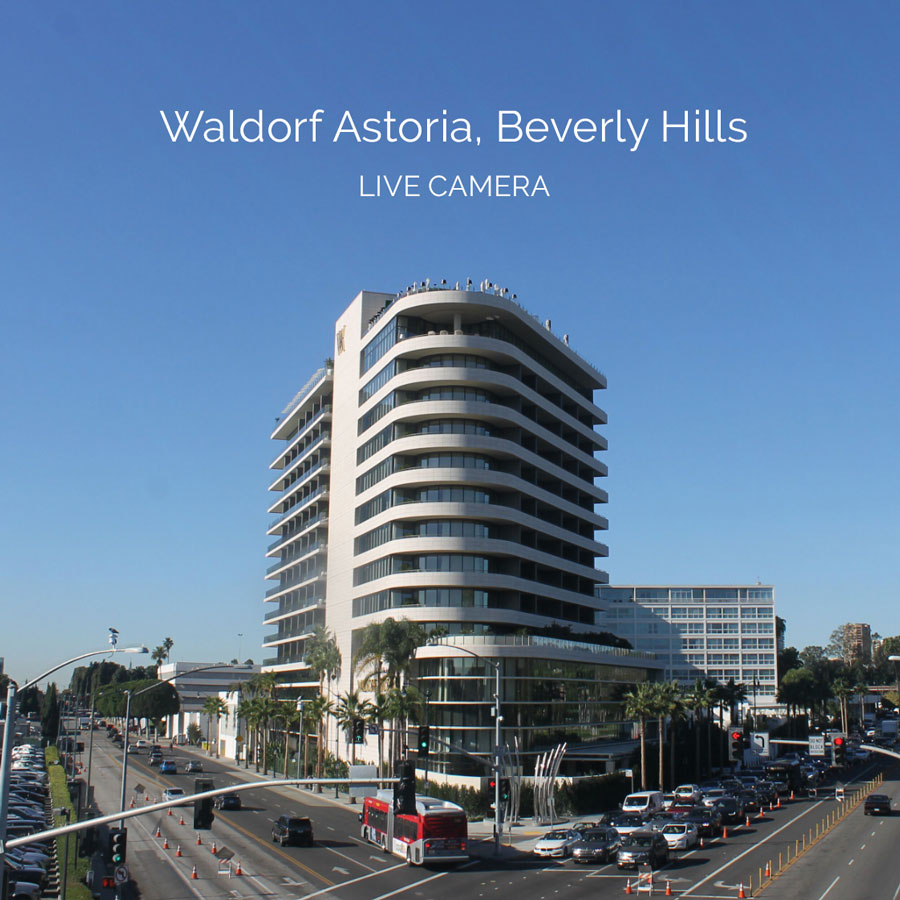

CaRE specializes in hotel development projects in US gateway cities and works with top industry professionals including Waldorf Astoria, Hyatt, Marriott, the University of Southern California, Jeffer Mangels Butler & Mitchell, David Hirson & Partners LLP, CBIZ, and Baker Tilly LLP. CaRE is comprised of MBAs, CPAs, Lawyers and Private Equity professionals with more than 60 years of experience investing, developing and managing real estate projects in North America, China, Latin America and Europe. Since 2011 CaRE has closed over $330 million in EB-5 capital from over 650 international investors financing over $850 of hotel developments and is creating more than 8500 new jobs in the US.

CaRE was established in 2010 by Steve Shpilsky and Michael Palmer.